Equity Model Portfolios – Platform Access (Smallcase & Others)

Rule-Based Equity Investing, Accessible to All

In today’s dynamic markets, investing in equity requires more than instinct—it requires structure. At Compounding Wealth Advisors LLP (CWA), our equity model portfolios are built on predefined, price-driven rules that bring discipline and clarity to the investing process.

Whether you’re just starting your equity journey or looking for a structured strategy to stay invested over the long term, our models help simplify your decisions through rule-based systems that adapt across market cycles.

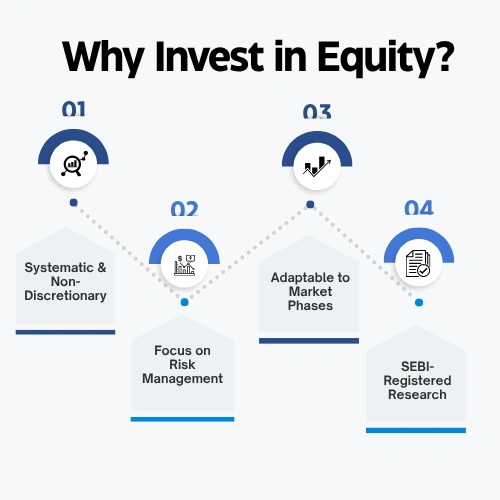

- Systematic & Non-Discretionary:Every investment decision is governed by rules—not emotions.

- Focus on Risk Management:Position sizing, dynamic exposure, and clear exit rules help manage downside risk.

- Adaptable to Market Phases:Our models reduce exposure during weak market phases and re-engage as strength returns.

- SEBI-Registered Research:Built under our SEBI Research Analyst license , our portfolios follow the highest standards of transparency and compliance.

Invest via Platforms like Smallcase

Our model portfolios are available on leading third-party platforms such as Smallcase, giving investors easy access to our research and strategies.

Benefits of Platform-Based Investing

Low Capital Requirements

Start with amounts suitable for retail investors.

Simple Execution

Invest, monitor, and rebalance with ease through integrated platforms.

Real-Time Visibility

Get transparent updates on portfolio performance and changes.

Backed by Rules

Each portfolio reflects the same structured, price-based research framework we use across all services.

Ideal for

- Retail investors

- First-time equity participants

- Investors seeking simple and structured access to rule-based strategies