Markets rarely move from weakness to strength in a straight line.

More often, leadership transitions are preceded by extended phases of consolidation — periods where returns remain muted, participation declines, and sentiment deteriorates.

The current environment reflects many of these characteristics.

Broad indices have spent long stretches moving sideways.

Small and micro caps have undergone meaningful corrections.

Confidence across risk assets remains fragile.

Historically, such phases have not marked the end of equity cycles. Instead, they have often played a critical role in resetting market structure and improving forward return probabilities.

Identifying Extended Flat Phases

To study this behaviour, we analysed periods where the Nifty delivered flat returns over approximately 18 months, defined as returns between –3% and +3%.

• Elevated macro uncertainty

• Policy or rate-related anxiety

• Weak momentum and reduced participation

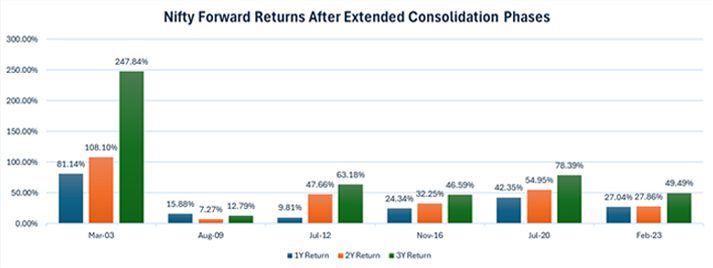

What History Indicates After Prolonged Consolidation

Key observations:

• Every observed instance shows positive 1-year forward returns

• Average returns improve meaningfully over 2- and 3-year horizons

• Forward return distributions are skewed positively following long consolidation phases

The implication is not certainty, but improved probability.

Extended consolidation tends to compress expectations, reset positioning, and rebalance risk — often creating a more favourable setup for future returns.

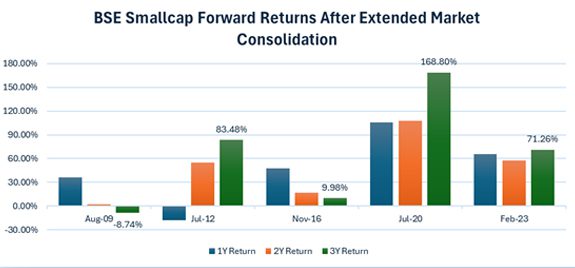

Small & Micro Caps Across the Same Market Setups

The same flat-market framework was applied to the BSE Smallcap index.

BSE Smallcap: Forward Returns

Key observations:

• Average forward returns are meaningfully higher than the broader market

• Short-term outcomes show greater dispersion

• Medium-term outcomes display a clear upside skew

However, history shows that once broader market conditions stabilise after prolonged stagnation, smaller companies tend to respond more strongly.

Why Small & Micro Caps Tend to Lead After Boring Phases Valuation and Expectation Reset

Flow Dynamics Across Market Capitalisation

Market recoveries often evolve sequentially:

• Stability emerges in large caps

• Risk appetite expands gradually

• Capital moves down the market-cap curve

Fundamental Catch-Up

While prices remain stagnant during consolidation, many smaller businesses continue to:

• Improve balance sheets

• Grow revenues

• Strengthen competitive positioning

When price begins to reflect these improvements, the adjustment is often sharper.

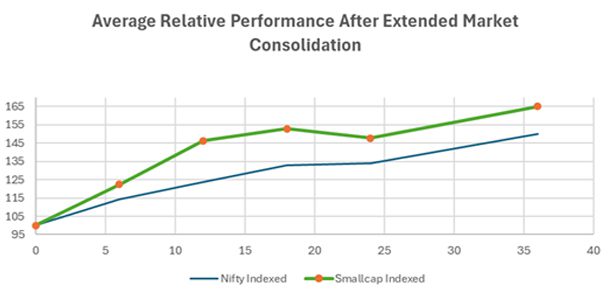

Relative Behaviour Matters More Than Absolute Returns

Average Relative Performance After Consolidation

Average returns after such phases

| Period | Nifty (5-cycle average) |

|---|---|

| 1 Year | ~24% |

| 2 Years | ~34% |

| 3 Years | ~50% |

| Period | Smallcaps (5-cycle average) |

|---|---|

| 1 Year | ~48% |

| 2 Years | ~48% |

| 3 Years | ~65% |

Indexed to 100 at consolidation exit; averaged across multiple cycles

Viewed on a relative, indexed basis:

• Smallcaps tend to assume leadership early in the post-consolidation phase

• Periods of consolidation often follow

• Outperformance tends to reassert over longer horizons

This highlights a structural tendency, rather than a one-off outcome.

Process Over Prediction

This analysis is not about forecasting market bottoms or predicting returns.

This is not about predicting.

It is about responding to price when probability improves — not when narratives become comfortable.

Extended periods of market boredom have historically improved forward odds.

Execution, however, remains strictly price-driven.

Key observations:

• Compressed expectations

• Reduced participation

• Elevated uncertainty

Historically, these conditions have preceded phases of broader market expansion — with small and micro caps frequently emerging as leaders once momentum rebuilds.

Risk remains.

Volatility remains.

Price confirmation remains essential.

But history suggests that market boredom is rarely meaningless — it often sets the foundation for the next phase of leadership.